UPDATE 28-03-2024: Frequently Asked Questions (FAQ)

Welcome to the FAQ section of Loop Biotech's crowd funding campaign. As a forward-thinking company with a commitment to improving our planet, we are currently raising €2 million through the crowdfunding platform Invesdor. We understand that potential investors have several questions and we are here to answer them. Below are answers to frequently asked questions about our campaign, the investment process and our vision.

About the investment round

1. What is the purpose of Loop Biotech's crowd funding campaign?

Loop Biotech aims to raise 2 million euros to further advance our mission of enriching nature. This capital will be used to grow our sales in the Netherlands and in Europe. In addition, we will make the necessary CAPEX investments in the production facility to scale up with it.

2. What is the minimum investment I can make?

The minimum investment is 3 shares (€262.50), through which we want to give a wide range of investors the opportunity to be part of our mission to enrich nature.

3. What do I get for my investment?

For your investment, you will receive certificates entitling you to shares in Loop Biotech, making you a co-owner and benefiting from the company's financial success.

4. How can I invest?

Investments can be made directly through the crowd funding platform Invesdor. Follow the instructions on the platform to complete your investment safely and easily.

5. Are there any risks associated with my investment?

As with any investment, there are risks associated with your investment. Of course, Loop Biotech is fully committed to achieving a significant increase in value.

6. How will certificate holders be kept informed? And with what frequency?

Certificate holders receive an update at least annually, including the Financial Statements. There is a standard business update twice a year, in the spring and fall.

7. Do you have anything recorded anywhere about dividend distribution? When you do and when you don't?

In this growth phase, achieving revenue growth has priority over dividend payments. Decisions on dividend distribution are made carefully in accordance with the Shareholders' Agreement (SHA), which sets out rules. These include investor approval for dividend payments exceeding 25% of annual net profit, and consultation with the board including financial examination of liquidity and solvency, based on relevant legislation (Article 2:216 of the Dutch Civil Code) and for the benefit of all stakeholders, including investors.

8. What is the expected increase in value of the organization over the years?

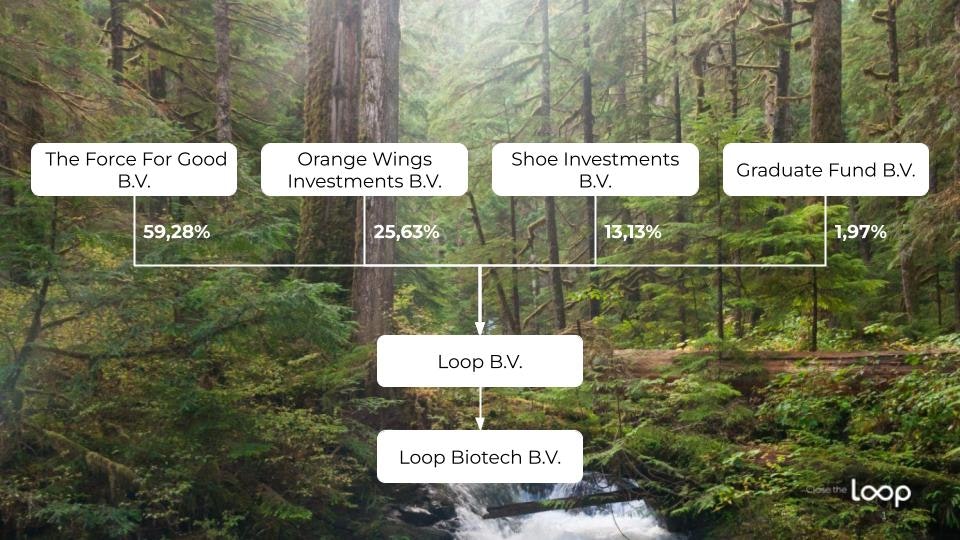

We are currently active in the venture capital journey, with our investors Shoe Investments and Orange Wings Investments aspiring for significant growth. Our goal is to achieve a 5-7x increase in value within 4-6 years, which fits with our ambition to generate significant returns for our investors.

About Loop Biotech

1. What makes Loop Biotech unique?

Loop Biotech offers an innovative and sustainable solution for funerals with the world's first patented mushroom funeral box made from local mushrooms and upcycled hemp fibers. These products not only help reduce harm, but actively enrich the health of our planet. With strong market demand and exclusive contracts, and a solid financial base and experienced team, Loop Biotech is firmly positioned for rapid growth. The growing market for eco-friendly burials offers significant investment potential. Join us in our mission to enrich the earth with Loop Biotech.

2. How does Loop Biotech use the funds raised?

a. Commercial growth: Expansion of the sales team with experienced professionals to drive revenue growth in the Netherlands and Europe, strengthening our global market position and increasing revenues.

b. Marketing investments: Develop digital and physical marketing campaigns to attract both consumers and businesses and build strong business relationships.

c. Factory investments: Increase production capacity and improve operational efficiency to meet growing demand for our sustainable products, while striving to reduce production costs and improve profit margins.

If you have any other questions, please do not hesitate to contact us. You can email us at info@loop-biotech.com or call us at +316 21 36 16 71. For questions related to the Invesdor platform, you can also contact Invesdor directly at 020-568 20 70 or email service@invesdor.nl. We are ready to help you!